Yes.

This post was first published in CJO GLOBAL, which is committed to providing consulting services in China-related cross-border trade risk management and debt collection. We will explain how debt collection works in China below.

If you send a demand letter to your Chinese debtor, you can improve the success rate of debt collection, although it is not guaranteed every time.

1. What is a demand letter in China?

In debt collection, a demand letter is a letter sent by a Chinese lawyer on your behalf to your Chinese debtor in order to urge the debtor to repay the debt in time.

2. When can you send a demand letter?

If a Chinese debtor has a debt that is due but unpaid, the lawyer can issue a demand letter on your behalf. This can indicate your attitude to the debtor’s breach of contract, or urge the debtor to correct the breach, or demand payment, refund or compensation.

3. What are the practical effects of a demand letter?

Sending a demand letter to the debtor may indicate that we have hired a collection agency in China and we take the debt seriously.

4. What are the legal effects of a demand letter?

(1) To interrupt the limitation period

In China, the limitation period for a person to request the people’s court to protect his civil-law rights is three years. If you fail to collect a debt within three years, you may lose your right to claim the debt. And a demand letter can make the three-year period run anew.

(2) To notify

A demand letter can serve as notification of rescission. If you wish to terminate a contract, you need to notify the other party. And a demand letter is a formal notice.

It can also serve as notification of a claim. You can make a formal claim through a demand letter.

(3) To clarify facts

If you have a complex dispute with a Chinese debtor, a lawyer can help you sort through the facts and legal issues to justify your claims to the Chinese debtor.

(4) To collect evidence

If the demand letter leads to the debtor’s response, it is possible for the debtor to confirm the content (or part of the content) of the demand letter in the response. Such confirmation can be used as evidence in future litigation.

(5) To prove bad faith

If the debtor refuses to repay the debt after receiving the demand letter, we may prove his/her bad faith in future litigation.

(6) To transfer costs

If the debtor ignores the demand letter and still refuses to repay the debt, we can prove that his/her bad faith causes the further increase of the debt or compensation costs. This will make him/her compensate more.

Also, this will be used as evidence for loss assessment in future litigation.

5. What are the disadvantages of a demand letter?

(1) The letter may alert the debtor

A demand letter is a double-edged sword, which may allow the debtor to know that you are ready to take action. This will speed up the debtor’s concealment and removal of assets, making it more difficult for us to collect.

(2) The letter is unenforceable

We cannot compel a debtor to pay the debt through a demand letter. Therefore, the debtor may ignore the letter.

* * *

Do you need support in cross-border trade and debt collection?

CJO Global's team can provide you with China-related cross-border trade risk management and debt collection services, including:

(1) Trade Dispute Resolution

(2) Debt Collection

(3) Judgments and Awards Collection

(4) Anti-Counterfeiting & IP Protection

(5) Company Verification and Due Diligence

(6) Trade Contract Drafting and Review

If you need our services, or if you wish to share your story, you can contact our Client Manager Susan Li (susan.li@yuanddu.com).

If you want to know more about CJO Global, please click here.

If you want to know more about CJO Global services, please click here.

If you wish to read more CJO Global posts, please click here.

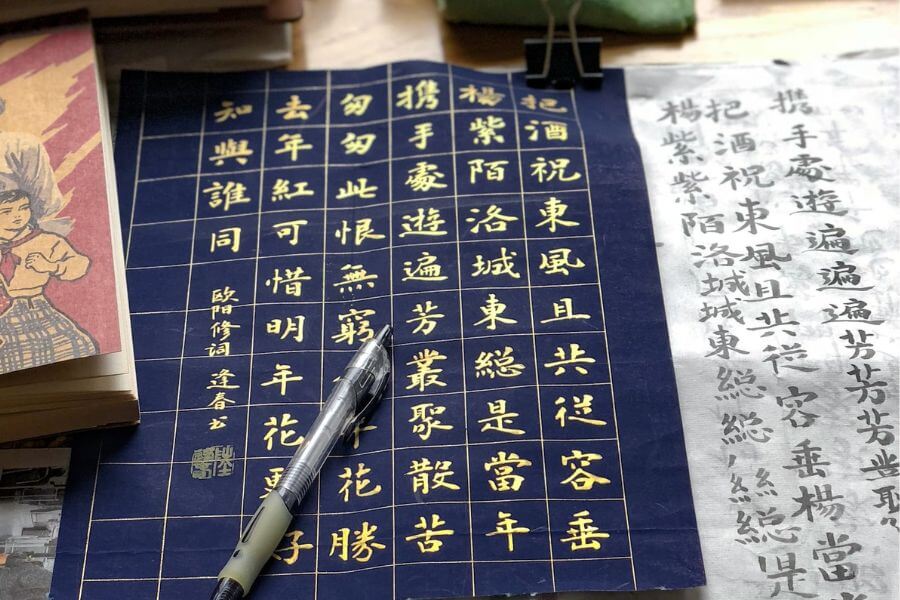

Photo by Timothée Gidenne on Unsplash

Contributors: Meng Yu 余萌